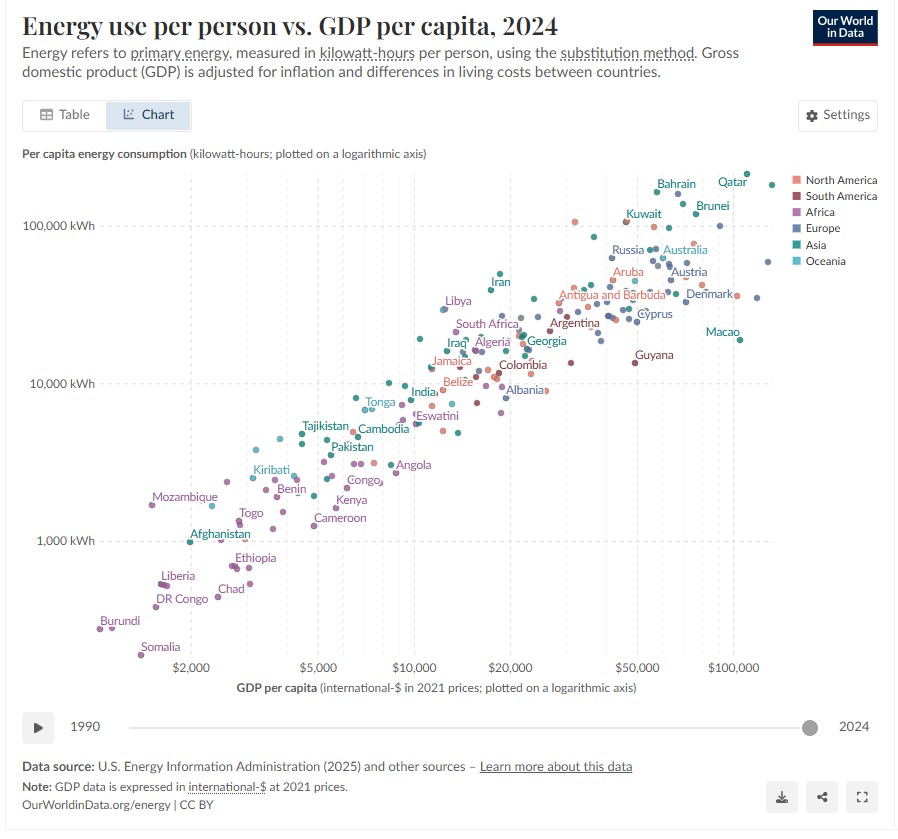

Take a second and look at this chart. Really look at it. The correlation is unmistakable; every wealthy nation sits in the upper right. No exceptions.

Here in the U.S., we live with a baseline of luxury that would have stunned our great-grandparents. Clean water flows from every tap. A slice of bread from wheat grown in the mid-west, milled locally, baked fresh, and yet costs a few cents. That’s not magic. That’s cheap energy doing the heavy lifting.

Energy is the ultimate force multiplier. A single stripper well produces more usable energy in a few days than a human being could generate in a year of physical labor. And most people never think about it. The landmen, geologists, drillers, engineers, entrepreneurs, and capital providers work in concert to bring that energy to market. The process is largely invisible to the consumer. But I’ve watched it happen for 50 years.

The hard truth embedded in that chart? Energy poverty is just poverty. You cannot build a modern economy on low energy consumption. Period.

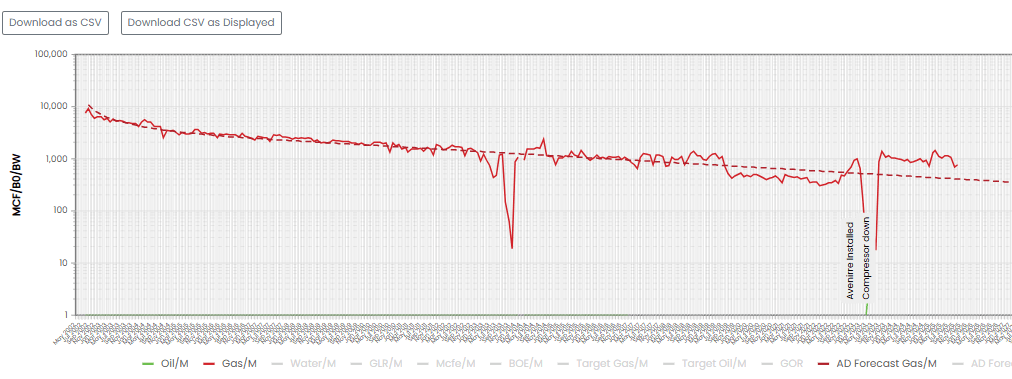

Which is exactly why production intelligence matters. Every barrel of Oil or MCF of gas left in the ground due to poor data, bad decisions, or missed optimization is lost economic value for operators, communities, and consumers alike.

That’s the problem Avenirre was built to solve.